The ASX 20 List highlights the 20 largest and most influential companies listed on the Australian Securities Exchange (ASX) by market capitalisation. Known for representing Australia’s leading blue-chip stocks, this list is a key reference for investors, analysts and traders looking to understand the backbone of the Australian share market.

What is the ASX 20?

The ASX 20, officially known as the S&P/ASX 20 (XTL) Index, measures the performance of Australia’s 20 largest companies by market value. These stocks are generally highly liquid and widely held, making the index a narrow but powerful gauge of corporate Australia.

Unlike broader benchmarks like the ASX 200, the ASX 20 captures almost half of the entire Australian equity market’s capitalisation, despite containing only 20 companies.

ASX 20 Companies

Note: Constituents and rankings change regularly due to market movements.

| Ticker | Company Name |

|---|---|

| ALL | Aristocrat Leisure Ltd |

| ANZ | Australia & NZ Banking Group Ltd |

| APT | Afterpay Ltd |

| BHP | BHP Group Ltd |

| CBA | Commonwealth Bank of Australia |

| CSL | CSL Ltd |

| FMG | Fortescue Metals Group Ltd |

| GMG | Goodman Group |

| MQG | Macquarie Group Ltd |

| NAB | National Australia Bank Ltd |

| NCM | Newcrest Mining Ltd |

| REA | REA Group Ltd |

| RIO | Rio Tinto Ltd |

| TCL | Transurban Group |

| TLS | Telstra Corporation Ltd |

| WBC | Westpac Banking Corp |

| WES | Wesfarmers Ltd |

| WOW | Woolworths Group Ltd |

| WPL | Woodside Petroleum Ltd |

| XRO | Xero Ltd |

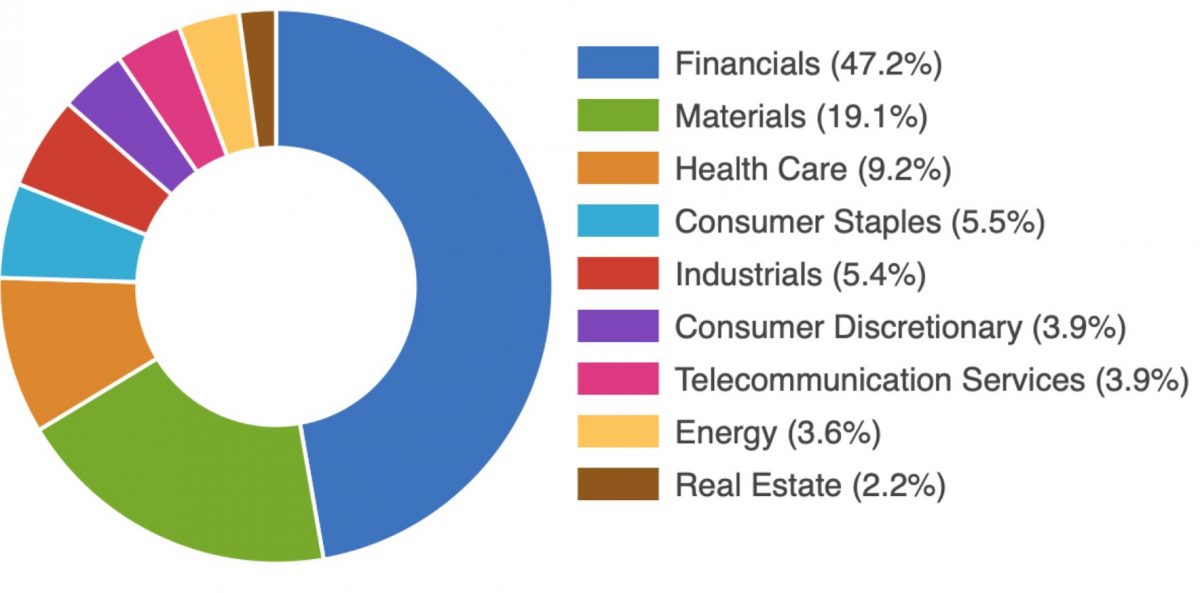

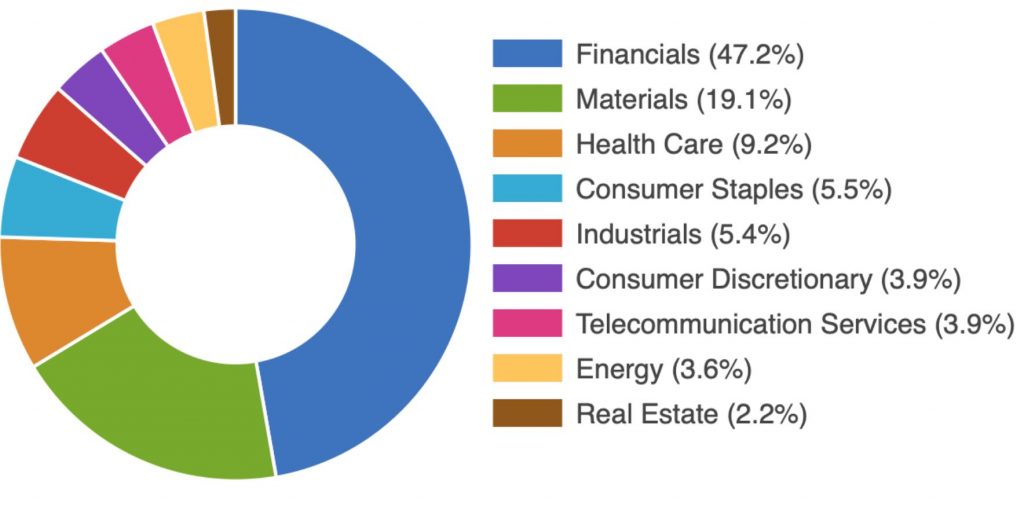

Sector Breakdown

The ASX 20 spans a variety of industries, though not all sectors are represented. Commonly covered sectors include:

- Financials

- Materials

- Health Care

- Consumer Staples

- Telecommunications

- Energy

Some sectors such as Information Technology and Utilities may not be part of the list due to company size and representation thresholds.

How the ASX 20 is Determined

Constituents in the ASX 20 Index are selected by Standard & Poor’s (S&P) in collaboration with the ASX. Companies must rank in the top 20 by market capitalisation (excluding ETFs and LICs) and meet liquidity and trading volume requirements. The list is reviewed and rebalanced quarterly — typically on a March, June, September, and December schedule.

Performance Metrics

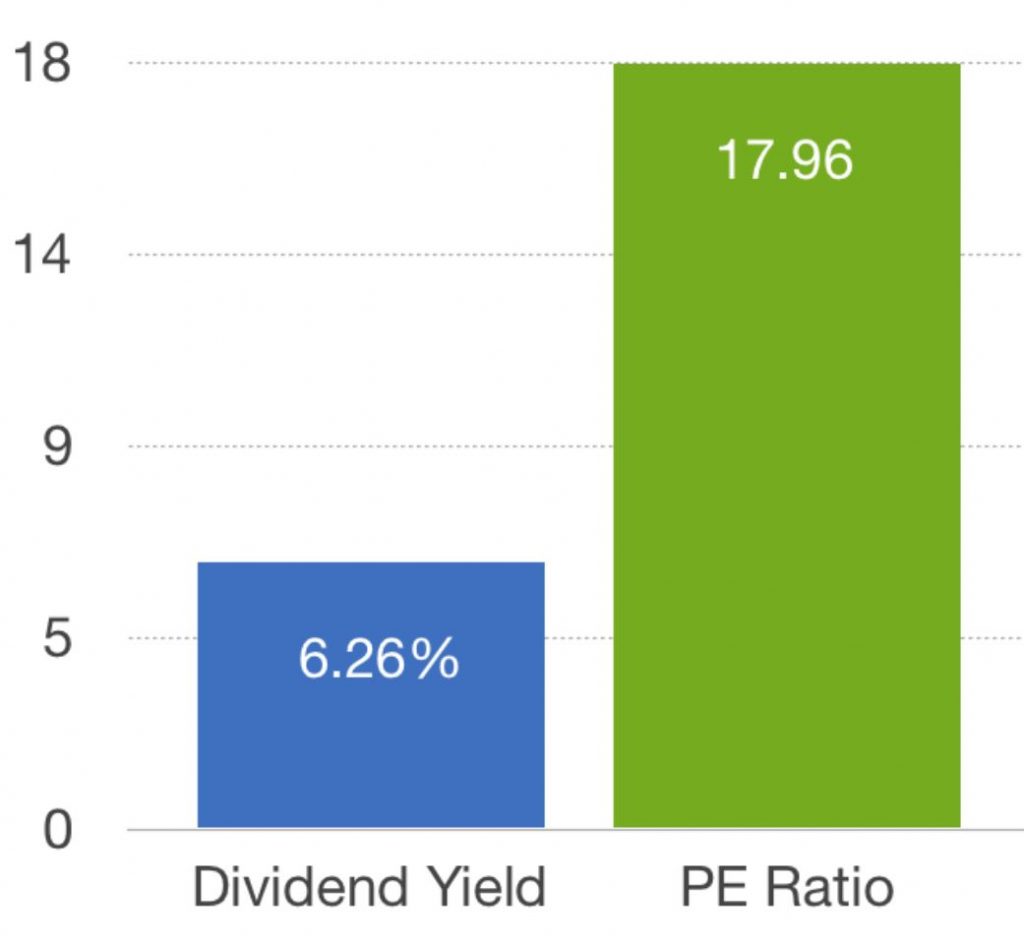

Investors often track broader metrics such as:

PE Ratio & Dividend Yield

These fundamental indicators help assess valuation and income potential for the ASX 20 Index, though individual stock metrics vary widely.

Exchange Traded Funds (ETFs)

At times, market products like the iShares S&P/ASX 20 ETF (ILC) have existed to mimic the index, offering way to invest passively in the largest Australian companies.

Why the ASX 20 Matters

- ⭐ Market Leadership: Includes Australia’s most valuable and stable corporations.

- 📈 Benchmarking Tool: Used by analysts to gauge overall market health.

- 🧠 Investment Insight: Blue-chip exposure indicates where institutional money flows.

- ⚖️ Diversification Snapshot: Though only 20 names, it often reflects the economy’s core sectors.

Frequently Asked Questions (FAQ)

Q: How often does the ASX 20 update?

A: The ASX 20 is typically reviewed quarterly (March, June, September, December) but can be adjusted mid-quarter if there’s an extraordinary corporate event.

Q: Is the ASX 20 the same as the ASX 200?

A: No. The ASX 20 tracks the top 20 by market cap, whereas the ASX 200 includes the largest 200 companies and is Australia’s primary benchmark.

Q: Can individual investors use the ASX 20 for investment decisions?

A: Yes — many investors use the ASX 20 as a starting point for portfolio research, although diversification strategies often include smaller or mid-cap stocks beyond this list.

Q: Do ETFs track the ASX 20?

A: Historically, products such as the iShares S&P/ASX 20 ETF have tracked this index, though availability and fees may vary.

Disclaimer

Information here is provided for educational purposes and isn’t financial or investment advice. Always consult a licensed financial advisor before making investment decisions.